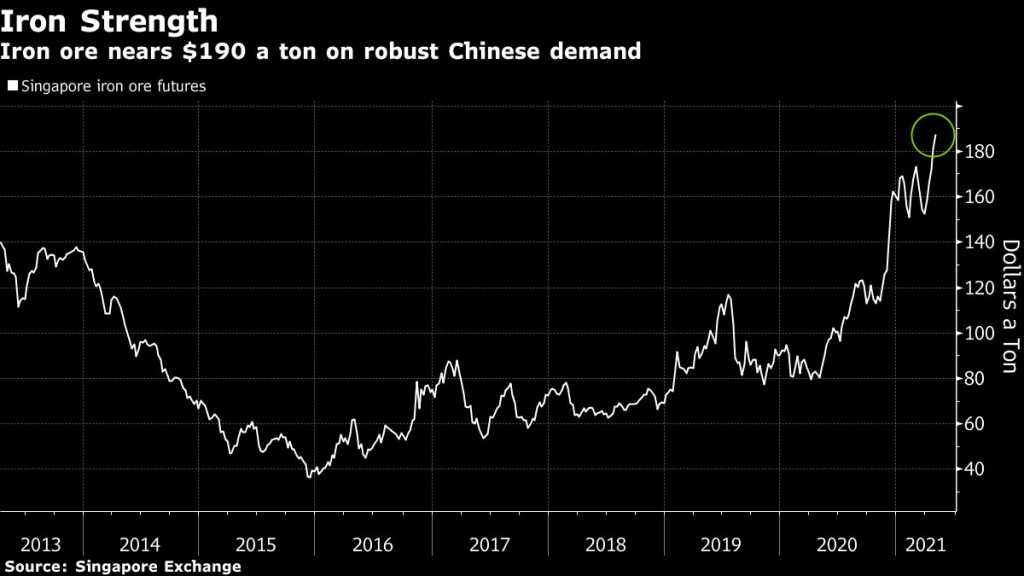

Iron ore price surges to record high

- Get link

- X

- Other Apps

MINING.COM Staff Writer | April 26, 2021 | 9:22 am Intelligence Markets News Top Companies Australia China Latin America Iron Ore

Iron ore prices jumped to a fresh high on Monday on robust Chinese demand.

Iron ore futures on the Dalian Commodity Exchange, for September delivery, closed 4.3% higher at 1,145 yuan. The contract jumped 6.3% earlier.

According to Fastmarkets MB, Benchmark 62% Fe fines imported into Northern China (CFR Qingdao) were changing hands for $193.58 a tonne on Tuesday, up 3.93% from Friday trade.

The high-grade Brazilian index (65% Fe fines) also advanced to a record high of $226.90 a tonne.

“Iron ore prices are mainly supported by structural contradiction of supplies, there’s shortage in medium and high-grade products,” Zhuo Guiqiu, analyst with Jinrui Capital, told Reuters.

Even the low-grade Super Special Fines with 56.7% iron content is at over 1,200 yuan a tonne, which is more expensive than the most-traded futures contract, Zhuo added.

Chinese steel futures also closed at all-time highs, underpinned by robust demand and concerns over production curbs.

The northwest Shaanxi province recently urged local departments, as requested by China’s state planner and other authorities, to verify local steelmakers’ crude steel output in 2020 and explain those whose production exceeded designated capacity or didn’t meet it.

Another major steelmaking city Handan in the Hebei province recently issued a notice, asking mills to implement production-control measures in the second quarter.

COPPER JUMPED TO A 10-YEAR HIGH AS COMMODITIES ADVANCE TOWARD THE HIGHS OF THE LAST SUPERCYCLE

The measures have sparked concerns of more curbs in the ferrous sector, lifting prices as demand is still strong during the peak season.

The most-active construction rebar on the Shanghai Futures Exchange, for October delivery, rose as much as 4.3% to 5,475 yuan ($843.63) a tonne. It closed up 2.3% at 5,371 yuan.

Top iron ore producers Rio Tinto, BHP, and Vale released disappointing output figures last week. And a weaker dollar is making commodities traded in the currency cheaper to buy.

Aluminum is surging and copper jumped to a 10-year high as commodities advance toward the highs of the last supercycle. Metals are benefiting as the world’s largest economies announce stimulus programs and climate pledges as they rebuild from the coronavirus shock.

“Biden’s new climate promises and at least lip service by China to greener domestic policies are keeping the demand picture rosy,” Tai Wong, head of metals derivatives trading at BMO Capital Markets told Bloomberg.

(With files from Bloomberg and Reuters)

Comments

Post a Comment