Pandora Papers: Inside Zimbabwean tycoon Billy Rautenbach's offshore family trust

- Get link

- X

- Other Apps

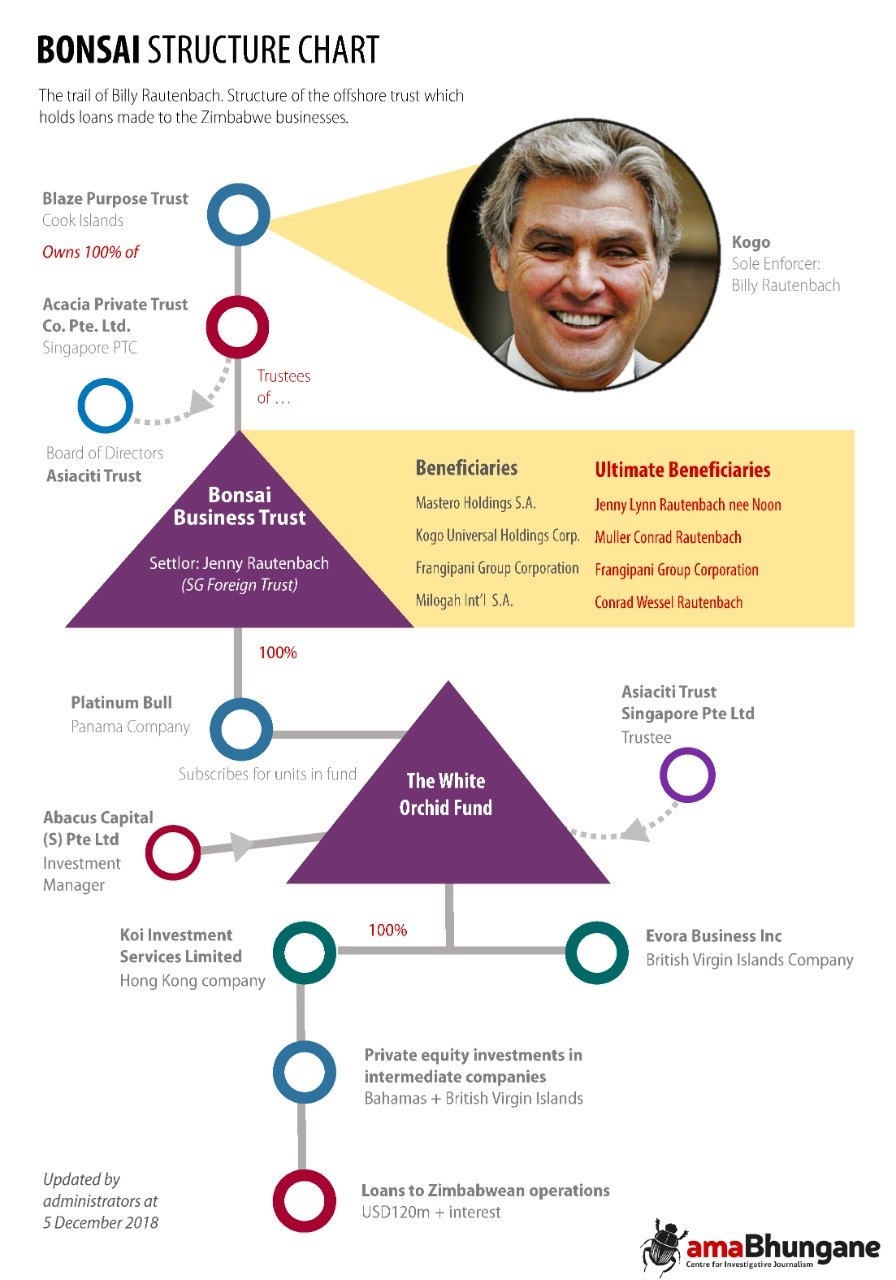

- Leaked documents show how an Asian specialist firm helped Zimbabwean businessman and Zanu-PF ally Billy Rautenbach and his family create a complex offshore trust fund while he was still under sanctions.

- The process was pursued under the banner of a marriage settlement and now places the ultimate ownership of the funds in the Cook Islands.

- Rautenbach has featured in previous offshore finance leaks, but this is the most detailed account yet of the mining and fuel magnate's family empire.

It started with a marriage settlement.

In 2013, one of Zimbabwe's richest men and arguably one of the most controversial business figures in Southern Africa, Muller Conrad "Billy" Rautenbach, donated multimillion-dollar financial investments in his coal and ethanol businesses to his wife.

This restructuring was explained by the need to "compensate" her for her role in building the family's wealth.

It would kick off a process in which Jenny Lynn Rautenbach, who also uses her maiden name Noon, would take the lead in establishing a complex offshore family trust fund meant to preserve and grow the family's assets for generations to come.

With the assistance of Singapore-based trust specialist Asiaciti and other advisors, by 2015 Noon was the settlor of the family's Bonsai Business Trust which owned a non-tradeable family investment fund listed on the Singapore Exchange (SGX). The main assets of the fund were inter-company loans (at punitive interest rates) repayable by Rautenbach's businesses in Zimbabwe.

But a closer look suggests that the donation was just a formality and Rautenbach, who was under US sanctions at the time, was still in control.

As one administrator clarified in an email, Noon was a "very indirect passive investor into the fund (and who does not even have direct profit entitlement or any kind of investment say)".

The donation had the effect of distancing Rautenbach at a time when he was still under sanctions - and of positioning the family to suck maximum benefit from the Zimbabwe operations should they ever be profitable enough to service the loans.

Records of the Rautenbach marriage settlement and family trust fund are amongst a batch of 1.8 million files leaked from Asiaciti's computer servers.

The data provides a partial window into Rautenbach's more recent business exploits - including details about the significant financial losses sustained by his company Green Fuel, a $300-million ethanol joint venture company with the Zimbabwean government that has been described as "his greatest achievement".

The files form part of the Pandora Papers, an anonymous leak of more than 11.9 million documents from the databases of 14 corporate service providers that set up and manage shell companies and trusts in tax havens around the globe.

The International Consortium of Investigative Journalists (ICIJ) is leading the investigation and has shared these files with over 600 journalists across the world in the biggest journalistic collaboration in history. The leaked documents mainly consist of word and PDF files, images and email conversations in the period between 1996 and 2020 and in some instances as far back as the 1970s.

AmaBhungane analysed a number of company documents and a trail of email communication beginning in 2013 when the Rautenbach trust fund structure was constituted.

Detailed questions were sent to Green Fuel and to Rautenbach's personal assistant, but received no response.

Asiaciti explained in its email response that it worked with clients across the world and its services were "subject to stringent regulation by the relevant authorities in each jurisdiction in which we operate". (See their detailed response below.)

15 years in Southern and Central Africa

Rautenbach's controversial reputation flows from allegations of using his proximity to government leaders to gain favourable access to business opportunities.

The compliance and risk documents seen by amaBhungane show that Asiaciti consistently rated the family's trust fund structure as "high risk" - primarily due to Rautenbach's status as a politically exposed person (PEP), his influence in Zimbabwe, the negative reports around his businesses and the substantial debt exposure the fund had to his businesses.

He spent the period between 1999 and 2009 as a fugitive from South Africa after he fled the country when he was charged with corruption and customs tax fraud. His company, S.A. Botswana Hauliers (SABOT) would later pay a fine of R40 million, but Rautenbach never admitted any personal liability and charges against him were withdrawn as part of the 2009 settlement.

Rautenbach's controversial ties to leaders of former Zimbabwean President Robert Mugabe's Zanu-PF regime eventually landed him on the US and European Union (EU) sanctions list in 2008.

The US called him one of Mugabe's "cronies" and accused him of providing "support to senior regime officials during Zimbabwe's intervention in the Democratic Republic of the Congo".

Billy Rautenbach’s business tentacles once stretched so far beyond Zimbabwe’s borders that he was called "Napoleon of Africa".

South Africans, though, may have forgotten this Napoleon.

He has been largely absent from our headlines for a long time.

But before he fled the country in 1999, Rautenbach was very much in our news, dramatically accused by the National Prosecuting Authority (NPA) of stealing his own company’s cars, bribing customs officials, involvement in the murder of a business rival, gun running and diddling the tax authorities.

But as he likes to point out, he was never found guilty of anything. Indeed, his slate was wiped clean in 2009 when all charges against him were withdrawn. He later that year testified for the NPA against then commissioner of police Jackie Selebi.

Muller Conrad "Billy" Rautenbach was born in what was then Salisbury, Rhodesia, in 1959. His father, Wessels, owned a trucking company, Wheels of Africa, that steadily expanded across transport-starved sub-Saharan Africa. Billy had charm, an easy smile and film-star looks. He showed talent as a rally racing driver.

Instead, he took over his father’s business, moved it to Johannesburg and built a rather ordinary company into a labyrinth of some 150 companies across the continent and beyond, ranging from trucking to farming, cobalt, platinum and coal mining, car assembly and distribution, including Volvo trucks and Hyundai cars.

His business style: taking outrageous risks and palling up with politicians as circumstances required.

His public notoriety began when, without a scrap of mining experience, he was granted lucrative concessions in the Democratic Republic of the Congo (DRC).

The backstory was that the Congo’s recently-installed strongman Laurent Kabila required the help of Robert Mugabe’s Zimbabwean troops to drive out the regime of Mobuto Sese Seko the previous year. Mugabe in turn wanted payback.

Hours after a meeting with Mugabe in 1998, Kabila appointed Rautenbach as chief executive of the state-owned mining company, La Générale des Carrières et des Mines, better known as Gecamines.

Rautenbach’s closest ally was not Mugabe himself, but his right-hand man, Emmerson Mnangagwa, who would one day succeed Mugabe as president.

Months later in 1999, South African investigators raided Rautenbach’s Johannesburg office and his mansion, seizing three truckloads of documents. Rautenbach fled South Africa in a hurry.

Rautenbach’s South African companies were placed in liquidation, leaving debts in excess of R1-bilion. A private jet, a helicopter, a house and six apartments in Johannesburg, a Cape wine farm and another farm in KwaZulu-Natal were among the assets seized.

This would be only the first of many punishing blows Rautenbach would suffer - blows that, remarkably, did nothing to stop him.

Ten years later in 2009, Rautenbach would reach a deal with the South African authorities: charges were dropped in return for his company pleading guilty to tax offences and paying of a wrist-slap fine of R40-million.

Meanwhile in the DRC, the Rautenbach honeymoon with Kabila did not last long: in 2001, Kabila accused Rautenbach of cheating him out of millions and seized back his Congo assets, including processing plants and land containing rich deposits.

Yet even that was not the end of Rautenbach’s DRC relationship. Kabila was assassinated not long after and replaced as president by his son Joseph in 2001, who smoothed over relations with Rautenbach.

Thus began a complicated yo-yoing relationship with the Congo, in which Rautenbach was at times restored to favour and a hand in the mining concessions – among the richest in the world - and at other times spurned.

Rautenbach’s most notable relationship was with the Central African Mining & Exploration Company (Camec), a British-based company into which his Congolese and Zimbabwean mining interests were merged.

Among the resources that came under Camec’s purvey were platinum mines that Mugabe had wrested from South Africa’s Anglo-Platinum.

Camec provided a base from which to do political favours. In 2008, the increasingly unpopular Mugabe faced the likelihood of losing the upcoming elections.

Camec was used to funnel some $100-million to bankroll an election campaign of violent intimidation and bribery which allowed Mugabe to consolidate his grip on power.

This did not go unnoticed. Soon after, Rautenbach landed on the sanctions lists of both the USA and the European Union, accused of being Mugabe’s "cronies", engaged in corrupt dealings in both the DRC and Zimbabwe.

Not that this did much damage to Rautenbach: the next year he sold out of Camec, netting himself a reported $50-million payout.

In 2009, Rautenbach moved into what seemed a surprising new line of business, building a huge ethanol processing plant named Green Fuels, in partnership with the state’s agricultural development authority. It was a failure: there was little interest in ethanol-based products, and the plant faced closure.

But in 2011, faced with chronic fuel shortages as a result of sanctions, Zimbabwe introduced the mandatory blending of all petrol with 15% locally-produced ethanol. It was a lifeline.

Rautenbach and his government allies have been able to trumpet their world-beating environmental credentials, using an agricultural replacement to cut down oil imports, creating thousands of rural jobs and providing electricity for homes. Ethanol is said to have saved the country tens of millions each year.

But critics have provided a very different version. The same Mugabe government which very publically expelled 6 300 white farmers from commercial farms, has rather more quietly deprived thousands of black peasant farmers of their land – in the interests of Rautenbach’s growing business.

In 2014, a villager told a visiting parliamentary delegation: "When the company came into the area, we were happy and thought we were going to benefit. However, when they were taking over our fields, they destroyed our maize and cotton which was ready for harvesting and even destroyed graves of our relatives."

Others made similar allegations, including that they received no compensation for their loss of land.

Producing ethanol from sugar cane is by no means always environmentally friendly. An unusually forthright 2015 parliamentary report accused the company of polluting waterways. It also said that the huge fuel trucks racing along rural back roads were creating other problems including a rise in fatal accidents, particularly among children.

The controversy continues to this day. In July 2021, reports alleged Green Fuels security guards armed with guns and dogs supported tractors which ploughed up crops and destroyed buildings owned by over 1 000 households in the village of Chinyamukwakwa, Chipinge.

Villagers had begged for two months grace so that they could harvest their crops at the end of August. Their pleas were ignored.

There was, as usual, no comment from Rautenbach. But with his patron Emmerson Mnangagwa firmly installed as president, he has little reason to worry about his future.

Useful amaBhungane articles on Billy Rautenbach:

Rautenbach’s fast and furious ride to riches

Mugabe’s white ally in land-grab row

Both Noon and Rautenbach submitted letters to Asiaciti declaring the source of funds for the assets which would be placed in the trust fund.

In his letter, Rautenbach states the family's wealth was a result of "financing and equity investments I have made over the past 15 years in Southern and Central Africa, mostly Zimbabwe".

"The origin of the capital used to finance and develop these activities stems from the original family transport and logistics business SABOT, as well as from the mining operations in the DRC which were sold to the AIM listed Central African Mining and Exploration Company Plc (CAMEC) in 2006, in exchange for cash and shares".

CAMEC was sold to Eurasian Natural Resources Corporation (ENRC) in 2009 and, while Rautenbach was under sanctions, it is reported that he made an estimated $50 million from the sale.

Motivating the transfer of assets to his wife in 2013, Rautenbach wrote: "This donation was made in order to compensate for the effects of the default marital regime under which we were married in 1984 and which today does not reflect or adequately provide for all the support and hard work she has contributed over the years to help growing our investments."

Documents show that Noon, who, in one email was described as a "lady who has more of an 'Old style Europe' family wealth background", also transferred her own "traditional family wealth" into the trust structure - but the main assets were loans Rautenbach made to his businesses, the most significant chunk flowing to Green Fuel.

Green Fuel is a biofuel company which produces ethanol from sugarcane.

It's owned by Rautenbach's Rating Investments and Macdom Investments in partnership with the Zimbabwean state's Agricultural and Rural Development Authority (Arda) which pledged the use of its land leases where Green Fuel operates in exchange for a 10% stake in the company.

Zimbabwe introduced mandatory blending of all fuel with ethanol in 2011, a policy which created a monopoly for Green Fuel, which, until 2019, was the only licensed company that could supply ethanol for blending.

Rautenbach has been accused of paying government and Zanu-PF officials to maintain Green Fuel's dominance and increase the percentage of ethanol blend because, as the company's leaked financial documents show, this was critical for the plant's sustainability.

He did not respond to amaBhungane's questions about this, but has previously branded his most vocal accuser, former Zanu-PF fixer Temba Mliswa, as "an extortionist".

Over the years the percentage of ethanol that must be blended with fuel has increased and is now set at 20%.

Pandora's box

It is against this backdrop of alleged cronyism and corruption that Asiaciti agreed to administer the private family trust fund even before Rautenbach's sanctions were fully lifted.

While Rautenbach was removed from the EU and UK sanctions list in February 2012, the US and Isle of Man only lifted theirs in April 2014 and July 2014 respectively.

An initial client review form dated May 2013 Asiaciti states that the firm sought legal advice from a "US law firm" on the implications of Rautenbach's US sanctions and they confirmed Asiaciti's "ability to act".

Asiaciti is a trust specialist firm which offers "wealth structuring and asset preservation" services for ultra-wealthy individuals and their families. The company is headquartered in Singapore and also has offices in low tax jurisdictions such as the Cook Islands, Nevis, Panama and Samoa.

While it's not illegal for wealthy individuals or corporations to hold assets for succession planning in offshore trusts, a recent report by the Organisation for Economic Co-operation and Development (OECD) on the enablers of tax and white collar crime notes that trusts and other offshore structures can be misused to obscure beneficial ownership through complicated ownership layers often in several jurisdictions.

This reality is demonstrated in ICIJ's previous investigations such as the Paradise Papers and Panama Papers that have unearthed how wealthy individuals, world leaders and corporations - aided by major banks, legal firms and asset management companies - have exploited murky offshore structures to launder money, circumvent sanctions and dodge taxes.

Enforcer

Asciaciti did not respond to specific questions sent by amaBhungane, including a question on why it engaged the family while Rautenbach was under sanctions.

Even though Noon was the settlor (the person who transferred the assets into the fund) the leaked documents reveal that Asiaciti's administrators identified Rautenbach as the "effective controller... from the onset due to his donation of assets to his wife".

A 2017 risk PEP form says that he "continues to have significant influence in the structure".

The structure is made up of a family trust called the Bonsai Business Trust in Singapore, which holds the White Orchid Fund, a private family investment fund listed on the Singapore Exchange (SGX).

The layer under the fund consists of holding companies in Hong Kong, the British Virgin Islands and the Bahamas through which loans flow to the Rautenbach's Zimbabwe businesses.

At the top of the pyramid is the Blaze Purpose Trust which is the ultimate family ownership structure set up in the Cook Islands, a notorious trust destination favoured by those who want to protect their assets from litigation.

The sole enforcer and ultimate beneficial owner of the Blaze Purpose Trust is none other than Rautenbach, represented by his corporate alter ego Kogo Universal Holdings.

In other words, there is a convoluted line of control starting with Rautenbach's Kogo Holdings and ending with loans to, and equity investments in, operational Zimbabwean companies, among other things.

These assets were primarily made up of debt funding that had been extended to around five SPVs in the Bahamas and British Virgin Islands. Namely: Elloway, Jefton, Marigold, Lostworld and Bartlow who were intermediary lenders to Rautenbach's Zimbabwe companies: Green Fuel, Zim-Bio Energy, Ratings Investments, Clidder and Macdom Investments.

Buried in debt

The primary debt that the White Orchid Fund holds in Rautenbach's businesses amounts to approximately $120 million, with the greatest exposure being to Green Fuel.

But it is not clear how much of an asset those loans really are.

At the time the loans were placed in the fund in 2015 they were all in default and in 2016 auditors assigned them a net-asset value of just under $20 million; by December 2018 this value was registered by Asiaciti at around $18 million.

A look at Green Fuel's financial statements at the time (drawn from the leaks) shows that the company was making substantial losses and its future prospects were being buried under the weight of the debt.

In 2016, the company's auditors raised concern about its ability to continue as a going concern due to it suffering $12.8 million losses in that financial year and its current liabilities exceeding current assets by $229 million.

The bulk of the liabilities stemmed from interest bearing loans which Rautenbach made to himself at interest rates of between 8% to 20% per annum.

At least four companies, which are a part of the trust fund structure and can positively be linked to Rautenbach, accounted for $173 million of the $186 million debt which was due for repayment.

The debt, however, seems to be highly discretionary.

In a 2015 email thread where the payment projections of the structure are mentioned one of the administrators says, "As per the loan agreements there is complete possibility left to the Debtors to voluntarily pay accrued interest and principal during the term of the Loan, but they are under no obligation to - which is why the Management of the Companies may decide to vary at will their payment schedule."

In the end, the fact that "major financiers to the Project continue to provide support by extending the loan repayment periods" is listed as one of the mitigating factors to Green Fuel being classified as a going concern by its auditors.

Just as important was the ethanol monopoly.

The company admits that this is central to its future prospects stating that its dismal financial performance and cash crunch are due to the delays in government implementing the mandatory blending policy introduced in 2011, but only gazetted in 2013.

"In light of the fact that the Company is the only registered licensee for mandatory blending, such Mandatory Blending policy mitigates against any current material uncertainties and reaffirms that the Company will be financially viable going forward," the 2016 financials read.

During a 2016 trip to Green Fuel's operations in Zimbabwe, the Rautenbachs placed the blame for the company's financial challenges on the "disastrous economic policies" of the government and the liquidity crisis the country was facing.

"They confirmed [Green Fuel] had been continuing to lobby the central bank very hard in relation to allowing them to make USD payments on the loans outstanding as "operationally essential funding" but so far, have not succeeded," wrote one of the administrators in a file note.

Meanwhile, the Zimbabwean state - which has the option of increasing its shareholding to 51% of the business (according to a parliamentary committee report) - will have to wait for that mountain of debt to be cleared before expecting any return on its contribution into the joint venture, particularly the extensive land holdings it has provided for cane production.

For the Rautenbachs, the proceeds from the loans are meant to be "temporary investments to seed the [WOF], providing the capital for the making of actual private equity investments which will be in line with the Fund's investment objectives".

Which is what administrators told the SGX when the fund was applying to be listed.

High risk

In general, the loan agreements - at very high interest rates - appear designed to strip cash, alternatively equity, out of the operating companies, effectively rendering operators, other creditors and minority shareholders completely hostage to Rautenbach's offshore interests.

At the same time the prospects for the family to cash in appear to depend heavily on Rautenbach's ability to retain political support in the tottering Zimbabwean regime.

For instance, a 2014 report by the portfolio Committee on Youth, Indigenisation and Economic Empowerment noted that Green Fuel was given a blending licence despite not fulfilling the 51/49 percent ownership split as was stated in the country's indigenisation laws.

(Arda, the agricultural authority, has an irrevocable option to acquire up to 51% shareholding, but the company's debt burden must act as a significant disincentive.)

Green Fuel also depends on a favourable ethanol pricing regime, set by the Zimbabwe Energy and Regulatory Authority (ZERA).

In addition, an improvement in Green Fuel's performance and likelihood of future profitability is also highly dependent on being able to expand its harvestable sugarcane so that the plant can operate at its installed 100-million litre capacity: in other words getting access to more land.

Will Billy's bet succeed? Or will the White Orchid whither?

Time will tell.

Asiaciti responds

Asiaciti explained in an email response that it worked with clients across the world and its services were "subject to stringent regulation by the relevant authorities in each jurisdiction in which we operate".

"We maintain a strong compliance programme and each of our offices have passed third party audits for Anti-Money Laundering & Counter-Financing of Terrorism practices in recent years."

"However, no compliance programme is infallible - and when an issue is identified, we take necessary steps with regard to the client engagement and make the appropriate notifications to regulatory agencies," it said.

Asiaciti further stated that the information amaBhungane presented regarding the establishment of the Rautenbach trust fund structure "had many inaccuracies and instances where important details were missing" but did not clarify what those were.

04 Oct

![[Gallery] After 37 years of going missing, this plane reappears. [Gallery] After 37 years of going missing, this plane reappears.](https://images.outbrainimg.com/transform/v3/eyJpdSI6ImRhYjRmMWVkOGE0ZTNiYjBkMThkYTE2ZDk4MTAyOWNjYmFjNzFkNTU1ZjBiNzc1YTYwYTcxNTQ2OTc1YTdlY2YiLCJ3IjoyNDEsImgiOjE2MCwiZCI6MS41LCJjcyI6MCwiZiI6NH0.webp)

![[Gallery] These celebs never married, and now we know why [Gallery] These celebs never married, and now we know why](https://images.outbrainimg.com/transform/v3/eyJpdSI6IjY5YTkxZGU4YjRiNjkwNzU0MTNlZTk4YzM0ZDU2NTUzNjUyYmY0N2FjYTZkMjc2MzhjZjBhYTkwMmI3ZTRjNjgiLCJ3IjoyNDEsImgiOjE2MCwiZCI6MS41LCJjcyI6MCwiZiI6NH0.webp)

![[Gallery] Actor posed with a fan and didn’t realize who she was [Gallery] Actor posed with a fan and didn’t realize who she was](https://images.outbrainimg.com/transform/v3/eyJpdSI6ImI0Y2UxMDA2MmQ4NmFlYzkxYTBkOTllMmFjOGM4OTRhMTQzMjdmZDY0MTAxMTcyODMyMDU2YWU5ZTczODk0M2IiLCJ3IjoyNDEsImgiOjE2MCwiZCI6MS41LCJjcyI6MCwiZiI6NH0.webp)

Comments

Post a Comment